Artificial intelligence (AI) is no longer just a trending field; it is the backbone of the next technological revolution. Savvy investors are putting their money into companies that are leading the way in AI innovation, cloud computing, data center infrastructure, and machine intelligence.

In this article, we’ll discuss the top-rated AI stocks for 2026, why analysts are bullish on them, and which AI stocks you should choose to build a diversified AI stock’s investment portfolio.

Why AI Stocks Are a Must-Watch in 2026

This is important because AI is transforming industries ranging from healthcare and finance to manufacturing and entertainment, and it is still in its development stages. Companies that build the software, hardware, cloud services, and data infrastructure behind AI systems often experience rapid growth in revenue and profits.

Wall Street analysts base their recommendations primarily on the following factors:

- Growth potential and revenue projections

- Competitive advantages (e.g., proprietary technology)

- Adoption of AI in products and services

- Long-term scalability and market share

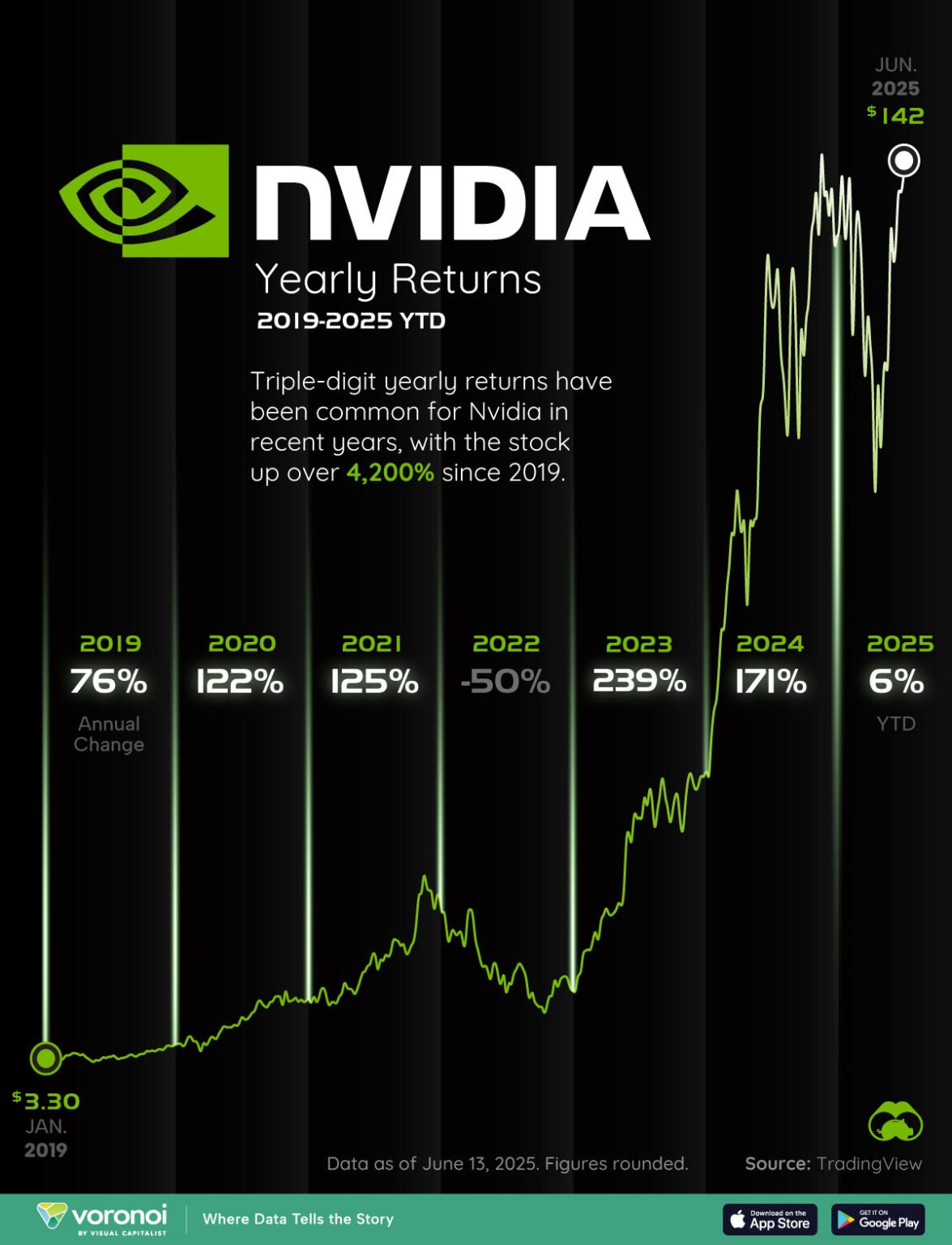

1. Nvidia (NVDA)

Why Nvidia?

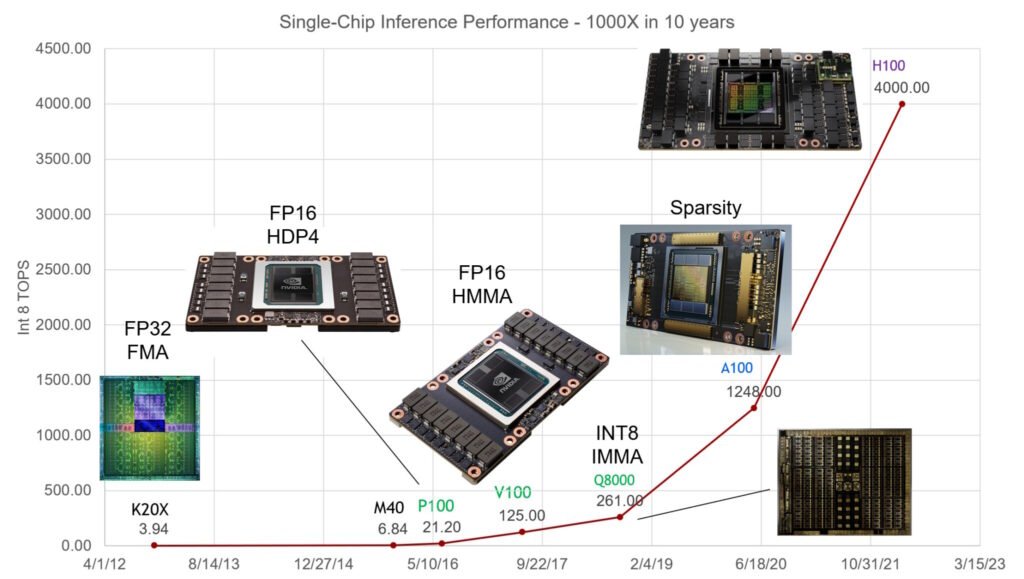

Nvidia is considered the world’s most important AI hardware company. Its GPUs (Graphics Processing Units) and AI systems power data centers, machine learning, cloud services, and autonomous system workloads.

According to Wall Street analysts, Nvidia is considered a top AI stock, citing its large market share in data-center GPUs and AI acceleration tools. In addition, Nvidia has also created its CUDA software platform, which includes an unparalleled number of code libraries, pre-trained models, and application frameworks that assist developers.

Nvidia holds more than 90% market share in data center GPUs, and the company has maintained its strong position due to its full-stack strategy.

Analyst Views

- Nvidia leads the list of top AI stocks compiled by Wall Street analysts and research firms.

- It has a massive installed base in training and inference hardware, making it crucial for enterprise and cloud AI.

- Nvidia’s future chip releases and expanding software ecosystem are expected to drive growth through 2026 and beyond.

📌 Importance: Importance: Nvidia is often considered a core holding for AI stock portfolios due to its superior technology and widespread adoption in the industry.

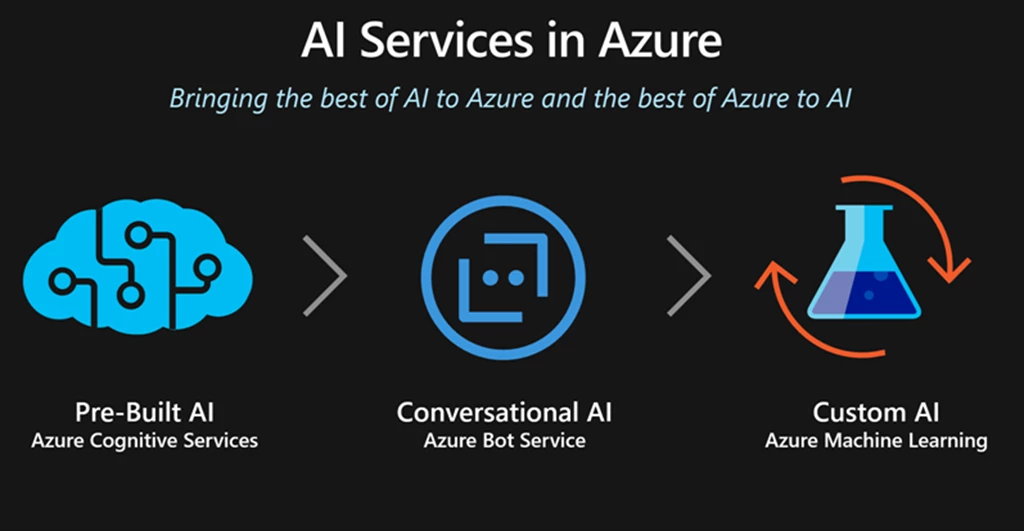

2. Microsoft (MSFT)

Why Microsoft?

Microsoft has strategically leveraged AI in:

Azure cloud services – Microsoft 365 Copilot – Enterprise software integrations – Big data platforms –AI now contributes significant revenue through enterprise cloud and productivity offerings.

Microsoft is the world’s largest enterprise software and productivity offerings company. It is best known for Microsoft 365, but the company also has a strong presence in other software verticals such as business intelligence, cybersecurity, and enterprise resource planning.

Microsoft has added generative AI copilots to several software products. Overall, many Fortune 400 to 500 companies now use Microsoft 365 Copilot. Based on its investment in OpenAI, the company has also emerged as a leader in the field of AI.

Analyst Insight

Morningstar and other analysts consider Microsoft a top AI stock candidate, given its integration of AI into its products and its strong position in the cloud computing market. Microsoft is viewed as a reliable tech company with strong AI execution capabilities.

📌 Tips for investors: For investors who want both stability and AI growth potential, Microsoft is the best company. It’s an excellent choice for AI stocks.

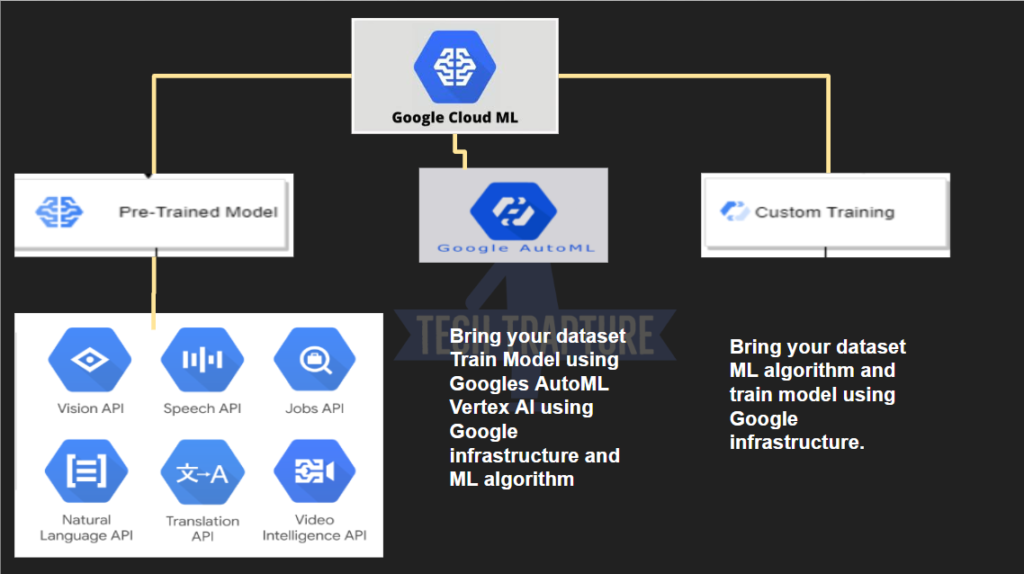

3. Alphabet (GOOGLE)

Beyond Search

Alphabet, the parent company of Google, has achieved significant success in the field of AI, particularly with its Gemini model and AI cloud integration. Recent reports indicate that these advancements in AI and strategic partnerships have propelled Alphabet’s market valuation to $4 trillion.

Analyst Takeaways

Analysts and users consider Alphabet not just an advertising engine, but an AI platform.

- Alphabet’s AI innovations are driving growth in Google Search, Cloud, YouTube, and emerging AI products.

- Alphabet’s AI tools are now being embedded in consumer and enterprise products.

📌 Tips for investors: Alphabet blends strong fundamentals with aggressive AI positioning — ideal for growth-oriented investors.

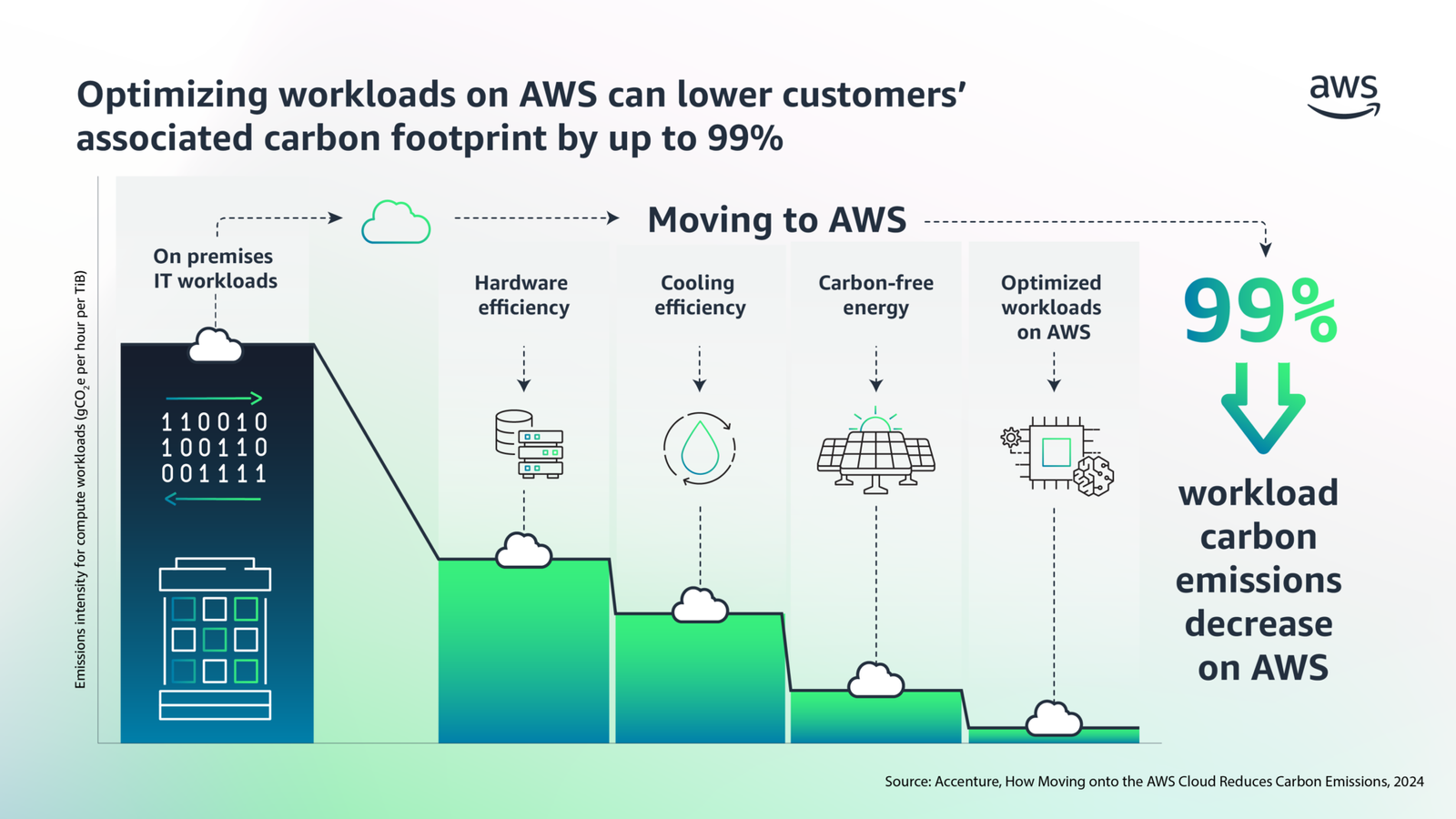

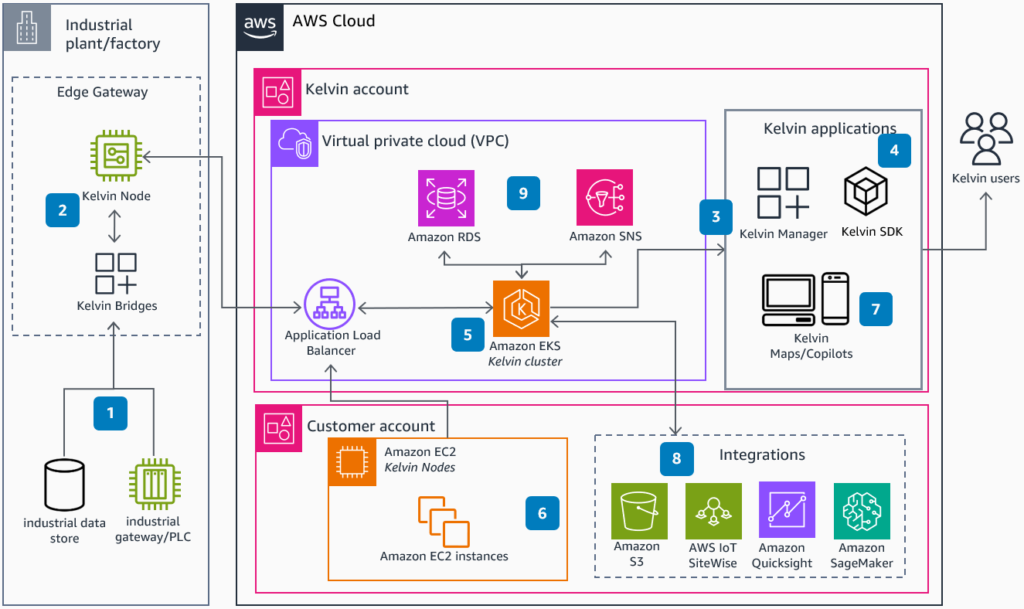

4. Amazon (AMZN)

The AI Advantage

Amazon is known for e-commerce, but its AWS cloud division has become a powerhouse in AI infrastructure. AWS provides tools for both AI developers and enterprises, including those for training, deployment, and analytics.

Wall Street Views

According to MarketWatch’s analysis, AWS’s growth and the increasing demand for AI, particularly in cloud services, could lead to a surge in Amazon’s stock price.

📌 Investor Tip: AWS profitability and AI integration should help Amazon maintain steady growth.

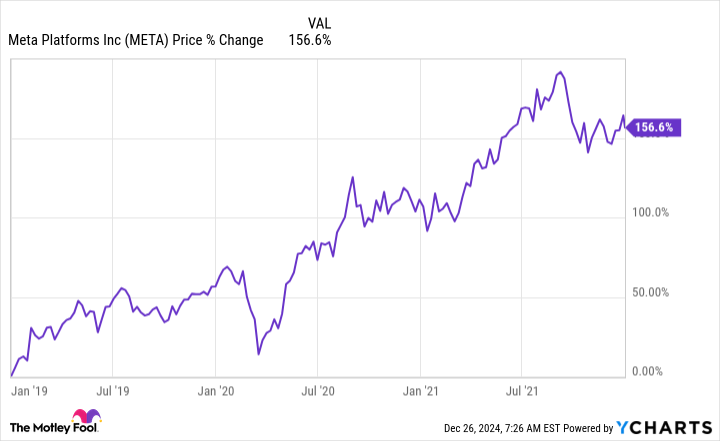

5. Meta Platforms (META): Social + AI Economy

Meta’s AI Strategy

Meta is no longer just Facebook, but also runs many other things, such as:

- Ad personalization

- Content creativity

- Virtual/augmented reality experiences

- Widely used AI assistants

Analysts at major banks are describing Meta as a “dark horse with significant upside potential,” particularly because AI tools are improving engagement and advertising revenue.

📌 Why it’s important for investors: Meta represents a higher-risk, potentially higher-reward AI investment for investors who believe in its social and immersive platforms.

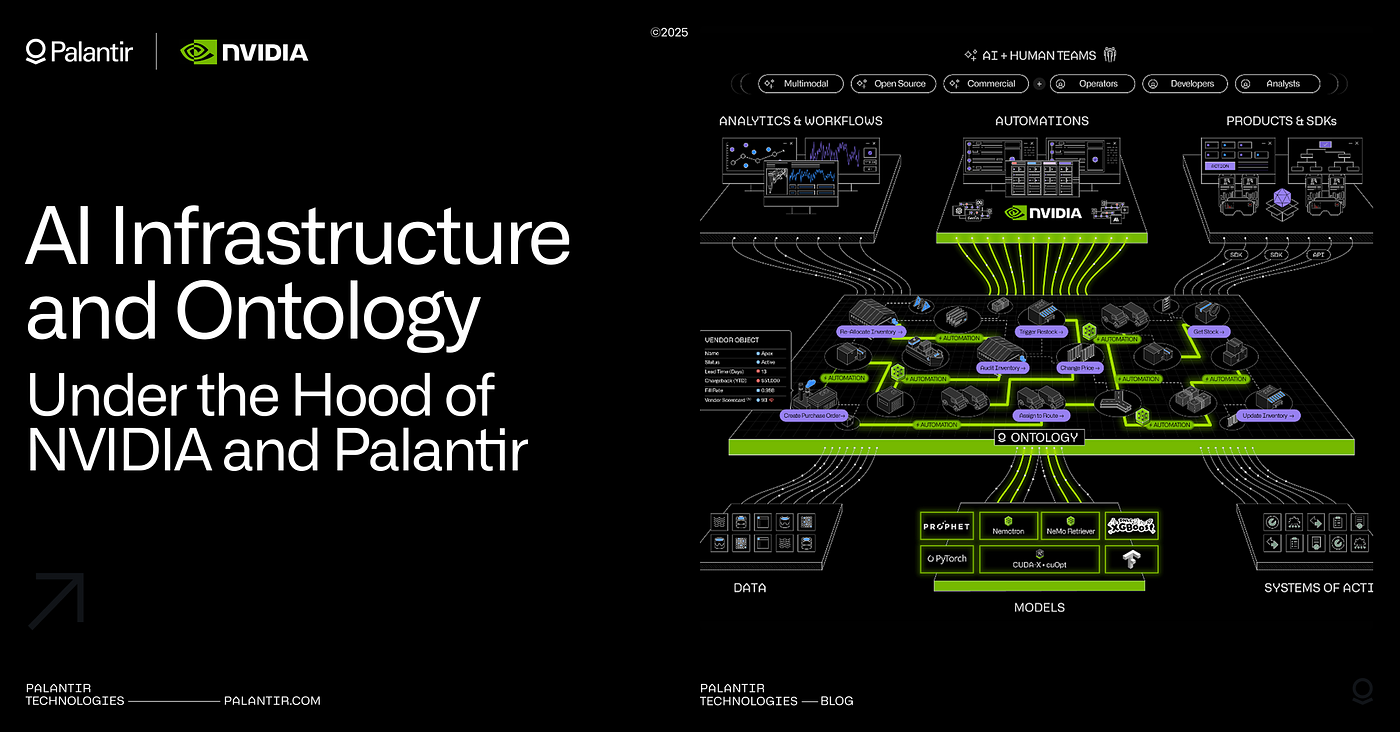

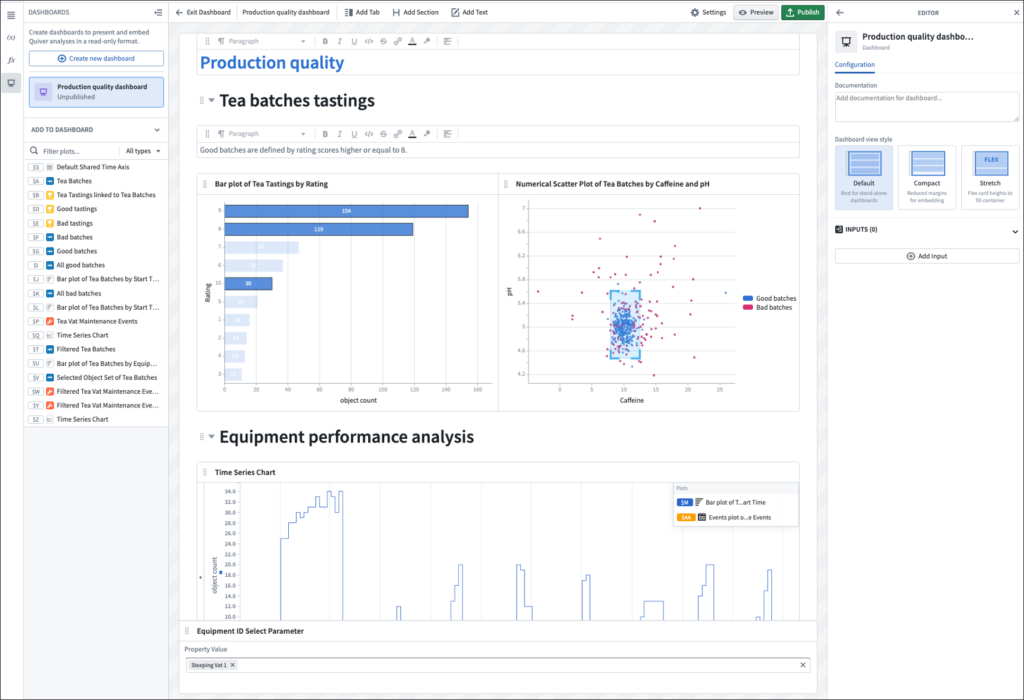

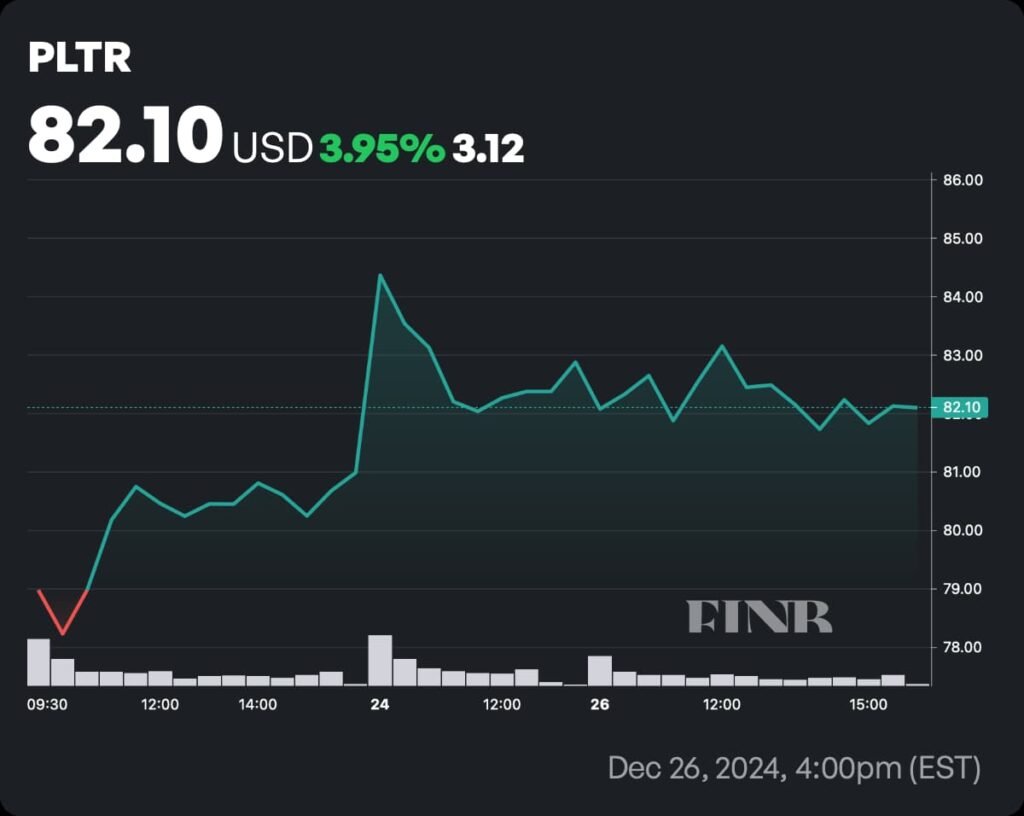

6. Palantir Technologies (PLTR): AI for Enterprise Intelligence

Why choose Palantir?

Palantir focuses on AI-driven data analytics and enterprise intelligence, particularly for government and corporate customers. Recent upgrades by city analysts have rated Palantir as a buy, citing strong revenue prospects through 2026.

📌 For investors: Palantir is ideal for investors looking for AI companies specializing in analytics and defense contracting.

7. Other AI Stock Picks Gaining Traction

Besides these, there are some other AI-oriented names that analysts mention as important for various portfolios, such as:

Taiwan Semiconductor Manufacturing (TSMC): Crucial to the global AI supply chain by manufacturing chips for Nvidia, AMD, and more.

Broadcom (AVGO): A major semiconductor player supporting AI systems. Analysts classify it among top AI investments.

Atlassian (TEAM): Enterprise software with AI-enhanced products and strong growth potential.

Upstart Holdings (UPST): AI-driven financial risk assessment, viewed as undervalued by select analysts.

AI Investing: Principles to Consider Before Buying:

- Understand your risk tolerance: Large tech stocks like Nvidia and Microsoft are less volatile than smaller AI companies.

- Maintain a balance between long-term and short-term investments: Some stocks may rise rapidly, others may stabilize, while others continue to grow steadily for years.

- Continuously introduce changes in the AI segment (Diversify): AI hardware (e.g., Nvidia, Broadcom), software/services (e.g., Microsoft, Meta), AI data infrastructure and analytics (e.g., Palantir, Atlassian).

- Focus on Fundamentals & Earnings: High valuations may already factor in growth — always check earnings and revenue trends.

Conclusion

AI has brought about some of the biggest changes to the investment sector this decade, particularly in AI stocks. Whether you’re an experienced investor or new to the market, understanding the leaders in AI innovation will help you make better decisions.

Wall Street analysts have consistently identified names like Nvidia, Microsoft, Alphabet, Amazon, Meta, and Palantir as key components of an AI stock portfolio, each with its own unique role and growth potential.